When it comes to real estate investing, owning a triplex can be a lucrative opportunity. Not only can you generate rental income from multiple units, but you also have the potential for long-term appreciation. However, one of the key considerations when purchasing a triplex is the down payment required. Understanding the minimum down payment can help you plan your investment strategy and determine how much capital you need to get started.

In fact, the minimum down payment required to purchase a triplex is 10% for the owner-occupier and 20% for those who just want to have income properties and who do not wish to live in them.

Buy A triplex

Down Payment for a Triplex

10%

Buy a Triplex for Owner-Occupied Triplexes

20%

Buy a Triplex for Investment

In this article, we will explore the minimum down payment for a triplex investment and the factors that can affect it. We will discuss the different loan options available, such as conventional loans, FHA loans, and portfolio loans, and their respective down payment requirements. Additionally, we will provide tips on how to save for a down payment and the benefits of having a larger down payment when investing in a triplex. Whether you are a seasoned investor or a first-time buyer, this article will provide valuable insights into financing a triplex investment.

Table of Contents

- How to calculate your minimum down payment depending on the total amount of the mortgage?

- Understanding the Minimum Down Payment for a Triplex Investment

- Exploring Different Loan Options for Financing a Triplex Investment

- Comparing the Down Payment Requirements for Conventional Loans, FHA Loans, and Portfolio Loans

- Tips for Saving for a Larger Down Payment on a Triplex Investment

- The 3 Potential Risks and the 3 Rewards Associated with a Triplex Investment

- Factors That Can Affect the Minimum Down Payment for a Triplex Investment

- How to Navigate the Process of Financing a Triplex Investment with a Minimum Down Payment

- Tips for Finding the Best Loan Option and Down Payment Strategy for a Triplex Investment

- We conclude with this Additional Information on Down Payments for Real Estate Investment

- Frequently Asked Questions

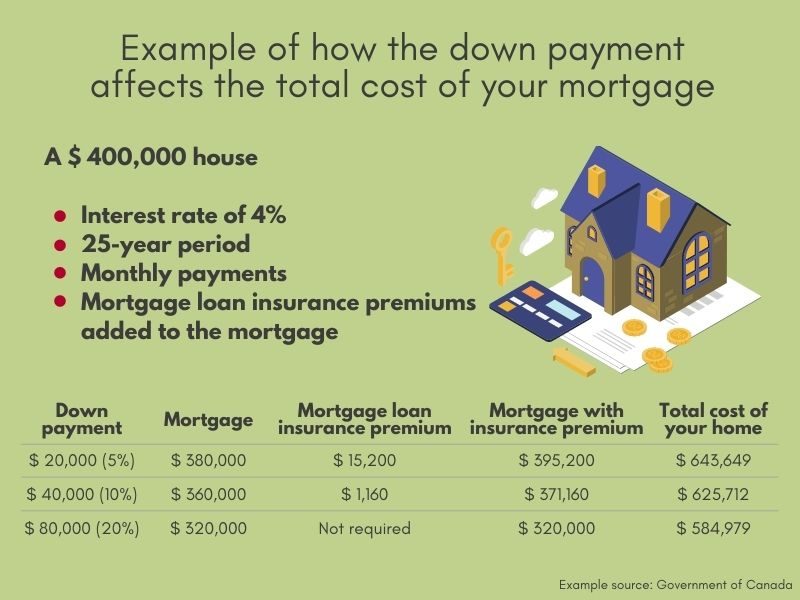

How to calculate your minimum down payment depending on the total amount of the mortgage?

Price less than or equal to $500,000

The minimum down payment is equal to the purchase price multiplied by 5%.

For example, if the purchase price is $460,000:

$460,000 x 5% = $23,000.

Between $500,000 and $1,000,000

The down payment = $500,000 x 5% + $200,000 x 10% = $45,000.

Greater than or equal to $1,000,000

The down payment = $1,100,000 x 20% = $220,000.

Understanding the Minimum Down Payment for a Triplex Investment

When investing in a triplex, the minimum down payment is a crucial factor that influences the initial investment and the financing options available. A triplex, which is a residential property with three separate living units, is often considered a more complex investment than a single-family home due to its potential for generating rental income.

Down Payment for Owner-Occupied Triplexes

For owner-occupied properties with 1-2 units, the minimum down payment typically stands at 5%. However, for a triplex or quadruplex, the minimum jumps to 10%. This increase reflects the higher risk associated with managing multiple tenants and the additional maintenance such properties may require. It’s important to note that if the purchase price is over $500,000, the minimum down payment for owner-occupied properties is still 5% for the first $500,000 and 10% for the portion of the price above that threshold.

Down Payment for Investment Triplexes

For properties that are purely investment-oriented and not owner-occupied, lenders typically require a minimum down payment of 20%. This higher threshold is due to the perceived increase in risk from a lender’s perspective, as the borrower will not be living in the property to oversee its condition and tenant behavior.

Influence of Mortgage Insurance

It is also important to consider the role of mortgage insurance when assessing down payment requirements. In cases where the loan is insured by organizations such as the Canada Mortgage and Housing Corporation (CMHC), the down payment requirements may be lower, as the insurance reduces the lender’s risk.

Contact Edgar Sanson

An experienced broker able to guide you throughout the process and provide the best advice to maximize your chances of success.

Exploring Different Loan Options for Financing a Triplex Investment

Finding the right financing for a triplex investment can be complex, but understanding the different loan options can make the process smoother and more efficient.

Conventional Loans

Conventional loans are a popular choice for real estate investors. These loans are not guaranteed by any government agency and usually offer competitive interest rates. However, they typically require a higher down payment and have stringent credit requirements.

FHA Loans

The Federal Housing Administration (FHA) offers loans that can be used for multi-family properties, including triplexes. FHA loans have lower down payment requirements—sometimes as low as 3.5%. However, they also require the property to be owner-occupied and come with certain restrictions and additional costs, such as mortgage insurance premiums.

Portfolio Loans

Portfolio loans are non-conforming loans that lenders keep on their own books rather than selling on the secondary market. These loans offer more flexibility with down payments and underwriting criteria. They can be particularly useful for investors who may not meet the strict criteria of conventional or government-backed loans.

Comparing the Down Payment Requirements for Conventional Loans, FHA Loans, and Portfolio Loans

Each loan type has its own set of down payment requirements, which can significantly affect the amount of capital needed to invest in a triplex.

Conventional Loans

Conventional loans for triplexes typically require a down payment of at least 15%-25%, depending on the lender and the borrower’s creditworthiness.

FHA Loans

FHA loans may allow for a down payment as low as 3.5% if the borrower has a credit score of 580 or higher. For credit scores between 500 and 579, the minimum down payment is 10%.

Portfolio Loans

Portfolio loans are more variable, with down payment requirements often negotiated on a case-by-case basis. They may range from 10%-25%, depending on the lender’s assessment of the risk.

Tips for Saving for a Larger Down Payment on a Triplex Investment

Accumulating a larger down payment can be beneficial for investors.

It can lead to lower interest rates, reduced mortgage payments, and better cash flow from rental income.

1. Automate Savings

Setting up automatic transfers to a savings account can help ensure consistent progress towards your down payment goal.

2. Reduce Expenses

Reviewing and cutting back on non-essential expenses can free up more funds for saving.

3. Explore Additional Income Streams

Consider side hustles or freelance work to supplement your income and boost your down payment savings.

4. Invest in Short-Term Financial Instruments

Investing in short-term financial instruments like high-yield savings accounts or certificates of deposit can grow your savings while keeping the funds accessible.

So, you can unlock the advantages of a substantial down payment for your triplex investment. Enjoy lower interest rates as lenders appreciate reduced risk. Experience improved cash flow with lower monthly mortgage payments, enhancing rental income returns. Benefit from better loan terms and more favorable financing options with a larger upfront investment. Build increased equity from the start, providing financial flexibility and security throughout your real estate venture.

The 3 Potential Risks and the 3 Rewards Associated with a Triplex Investment

Investing in a triplex involves weighing potential risks against potential rewards:

Rewards

- Consistent rental income

- Tax advantages

- Equity growth through appreciation and debt paydown

Risks

- Tenant turnover

- Unexpected repairs

- Market downturns

Factors That Can Affect the Minimum Down Payment for a Triplex Investment

The minimum down payment required for a triplex investment can be influenced by a variety of factors:

Credit Score

A higher credit score can lead to lower down payment requirements, as it indicates lower risk to lenders.

Property Location

Properties in certain areas may be deemed higher risk, leading to higher down payment requirements.

Income and Debt Ratios

Lenders will consider an investor’s income and existing debt obligations when determining down payment requirements.

Investment Experience

Seasoned investors may be able to negotiate lower down payments based on their track record.

How to Navigate the Process of Financing a Triplex Investment with a Minimum Down Payment

Navigating the financing process for a triplex investment with a minimum down payment involves:

Research and Comparison

Investors should research various lenders and loan products to find the best terms and rates.

Pre-Approval

Obtaining pre-approval for a loan can give investors a clear picture of their budget and strengthen their bargaining position.

Negotiation

Investors may be able to negotiate better terms or down payment requirements based on their financial standing and investment plan.

Tips for Finding the Best Loan Option and Down Payment Strategy for a Triplex Investment

Assess Personal Finances

Investors should thoroughly assess their financial situation to determine how much they can comfortably afford to put down.

Consider the Impact on Investment Returns

The down payment amount can influence the investment’s overall returns, so investors need to consider their target return on investment.

Seek Professional Advice

Consulting with a financial advisor or mortgage broker can provide valuable insights and help investors make informed decisions.

Stay Informed

Keeping abreast of market trends and changes in lending standards can help investors take advantage of the best opportunities.

Embarking on the journey of financing a triplex investment with a minimum down payment is an exciting venture, and here’s how to smoothly navigate through the process. First and foremost, kickstart your journey with thorough research and comparisons among different lenders and loan products.

This step ensures you uncover the best terms and rates tailored to your investment needs. Next up, secure pre-approval for your loan. This not only provides a clear snapshot of your budget but also fortifies your position in negotiations.

Speaking of negotiations, leverage your financial standing and investment strategy to potentially secure better terms or down payment requirements. With these steps, you’ll confidently navigate the financing process, making informed and advantageous decisions for your triplex investment.

We conclude with this Additional Information on Down Payments for Real Estate Investment

So, keep in mind the aforementioned tricks and the minimum you must have to buy a triplex in all of Canada.When investing in real estate, it’s important to consider the down payment requirements based on the specific property type.

For multiplexes like triplexes or quadruplexes, the minimum down payment is typically higher compared to duplexes. It’s also worth noting that putting a higher down payment can help lower your mortgage payments and potentially avoid extra fees like private mortgage insurance.

It’s recommended to consult with a mortgage professional to determine the best down payment strategy for your investment goals.

Real estate investments, including triplexes, have the potential for long-term appreciation, which can be influenced by Market Conditions and Improvements and Upgrades because the local real estate market trends can affect property values over time and investing in property enhancements can increase its value and appeal to tenants.

Frequently Asked Questions

A 20% down payment is ideal, unless you plan on buying mortgage insurance. However, where multiplexes differ is the minimum required down payment. Duplexes require a minimum 5% down payment, while a triplex or quadruplex will require a minimum of 10%.

For a $500,000 house, a 20 percent down payment is $100,000 — a large amount, but the more you pay upfront the less you’ll have to borrow, and so the lower your monthly payments will be. In addition, if you put down less than 20 percent, you’ll likely have to pay an extra monthly fee for private mortgage insurance.

You can calculate your minimum down payment by adding 2 amounts. The first amount is 5% of the first $500,000, which is equal to $25,000. The second amount is 10% of the remaining balance of $100,000, which is equal to $10,000.

With an owner-occupied duplex rental, the minimum down payment is 5% from the purchaser’s own resources (you cannot use borrowed money e.g. unsecured lines of credit).